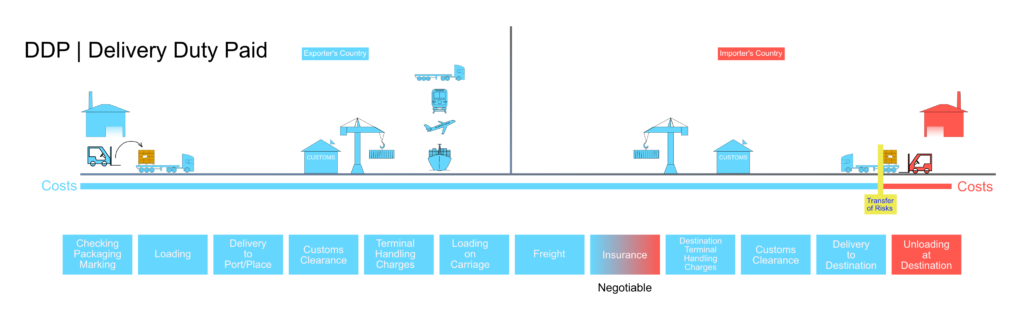

DDP, short for “Delivery Duty Paid”, means that the exporter is obligated to deliver the goods to the importer at the agreed delivery/destination point in the importer’s country and pay for all duties and taxes in both countries and, if any, transit countries.

The whole transportation process is carried out by the exporter’s forwarder. All the costs and risks from loading at the exporter’s premises to the delivery/destination point in the country of import are borne by the exporter. In addition, the exporter also assumes the costs of export, transit and import clearance which is risky for the exporter as it may not have anticipated everything about customs formalities, duties and taxes.

If the exporter has not a business background and knowledge in the country of import, it should avoid DDP and choose DAP or DPU, so the costs of transit and import clearance are for the account of the importer.

DDP is used in any mode of transportation.

How is DDP different from DAP?

DDP has the same rules as DAP with one exception; it requires the exporter to assume the cost of export, transit and import clearance. All the other rules of DAP also apply to DDP.

EXW and DDP are the riskiest Incoterms rules for both parties. While EXW imposes a maximum level of obligation on the importer, the exporter takes the maximum responsibility with DDP. So, we can say that it is best for the exporter to prefer DAP to DDP and for the importer to prefer FCA to EXW.

Recap

- The exporter contracts for the carriage of goods from its premises to the point of delivery/destination. The goods are loaded onto the collecting vehicle,

- The carrier leaves the border after the exporter’s customs broker clears the goods,

- The goods arrive at the destination country, cleared by the exporter’s customs broker and continue to the final agreed delivery/destination point.

- Upon arrival at the delivery/destination point, the carrier delivers the goods at the disposal of the importer ready for unloading. This is the point that the risks and costs transfer to the importer.